Coronavirus, and its Effect on the Tech Supply Chain

The coronavirus, now officially named CORVID-19, is starting to take a serious toll on tech companies, electronics parts manufacturers, and other industries. On Monday, stocks fell sharply in response to slowed production in China, caused by continued fears of a large scale outbreak (Source).

Almost 97% of all current CORVID-19 cases are localized to China, but with the recent outbreaks in Italy and South Korea, CORVID-19 is definitely making a global impact on it’s own. China is the world’s number one manufacturing region, however, and problems that happen there can affect the entire world’s supply chain.

China is the manufacturer of the world.

Starting in the early 1980s, and surpassing the United States in the beginning of the last decade, China has become the center of global manufacturing. Their cheap labor, massive populations, and sprawling cities made them a prime target for companies to source their parts and product assembly contracts, during an era when the world was beginning to globalize.

Globalization is now in full swing, and China’s economy has greatly benefitted from this shift in manufacturing. Now, decades after the manufacturing booms initial upswing, they find themselves at the epicenter of a global supply chain. If China slows down, or stops, the impact that has on the rest of the world is huge.

The outbreak of CORVID-19 has already caused enough major players to pull out of Mobile World Congress for it to be canceled this year, and the new disease has huge multinational corporations like Samsung and Apple closing factories in response. It seems that for the tech industry, the worst may still be ahead of us (Source).

How bad is the coronavirus affecting tech companies?

Pretty bad.

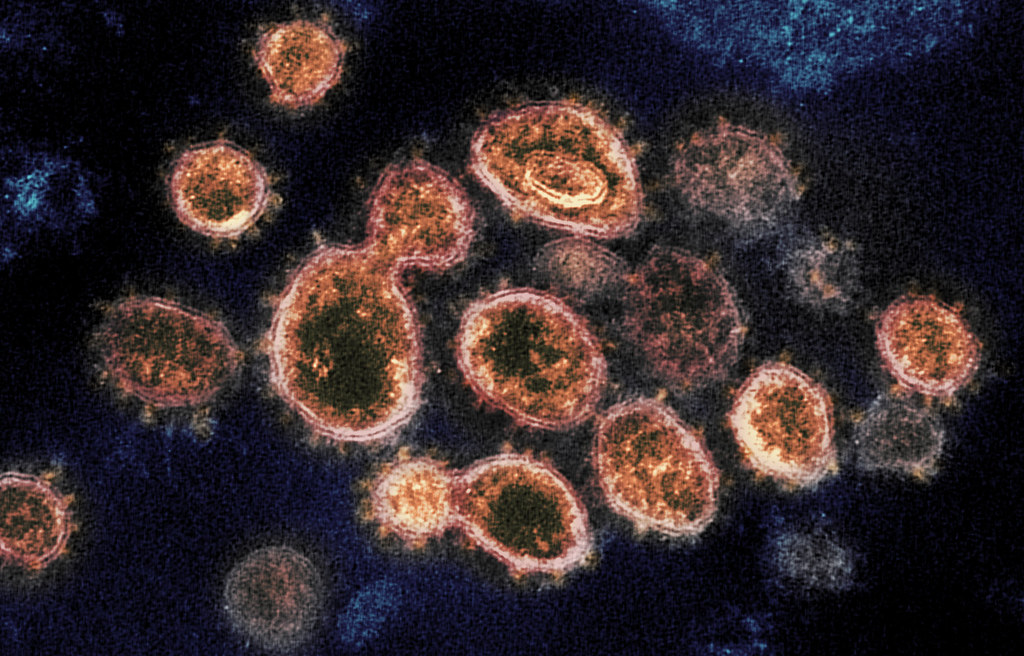

Coronavirus symptoms range from mild symptoms to severe illness and even death. Symptoms can include, fever, cough, shortness of breath, and pneumonia. The mortality rate is hovering just under 2%, but the disease seems to spread easily.

There have been several factory closure in and around china, and Apple’s primary iPhone factory is running on a skeleton crew because of restrictions on movement caused by CORVID-19. Apple is starting to worry about this situation having a lasting impact on it’s business, and has lowered it’s earnings estimates based on this. Facebook has also been affected, and they have set reduced production goals for its Oculus Quest virtual reality headsets due to a slowdown in Chinese manufacturing because of the virus.

The Chinese government is concerned that a large influx of workers returning from the infected regions could rapidly spread the virus. New rules have forced companies to strictly protect against the virus entering and spreading in factories. In many manufacturing provinces, state officials have instructed local health commissions to “step up oversight of workplace virus-control measures”.

China isn’t just the world’s biggest manufacturer, it’s also the second largest consumer market. So this means that along with other internationally operated businesses, Apple is not only having a hard time making its products, but it’s also having a hard time selling them.

What does this mean for my stock portfolio?

Probably nothing, long term. Despite the market’s sudden downturn, it will probably recover just as quickly. The unknown, here, is more than likely a ‘when’, rather than an ‘if’. It’s only a matter of time before things return to normal. These diseases and outbreaks are nothing new. As you can remember, SARS caused similar issues back in the early 2000s, albeit not on this scale.

There are already medications that are being tested to combat the illness. Gilead Sciences confirmed that it is working with health authorities in China on clinical trials for patients who have been infected with CORVID-19. Additionally, Biotech company AbbVie has reported promising results for treatment using a combination of two of its HIV medications and Tamiflu, a drug manufactured by Swiss and Japanese pharmaceutical companies.